The Best Credit Card Processing Companies (In-Depth Review)

- September 4, 2020

- Uncategorized

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

There are many touchpoints along the customer journey. The transaction is of course one of the most important, if not the most important.

So, the way in which you accept payments matters for both you and the customer. You need to have the right software and/or hardware in place to make sure transactions are simple and secure for both parties.

Not only that, as a business owner you need to know that you’re not shelling out cash on inferior services or unnecessary additional fees.

Therefore, this post will cover everything you need to know about choosing the right credit card processing company. Plus, I’ll introduce my top picks for a wide range of businesses of different sizes and with different needs.

The Top 10 Credit Card Processing Companies

How to Choose the Best Credit Card Processing Company for You

Here are some key elements to consider when choosing the right credit card processing company for you:

1. Fees

Look at the payment terms and fees carefully. Different companies offer different pricing models and things can start to get a little complex.

Firstly, there are interchange fees, which is the percentage taken by the company on every transaction made. Full-service credit card processing companies also take a monthly fee. There may also be additional costs, such as setup or monthly minimum fees.

2. Accepted Payment Methods

Nowadays, you need a payment processing company that accepts more than just debit and credit cards. Digital wallets like PayPal, Google Pay or Apple Pay have become extremely popular.

3. Customer Experience

When shopping, customers want the entire experience to be quick and easy. This is particularly important in e-commerce where the checkout process needs to be streamlined.

In fact, a long and complicated checkout process is the number three reason why consumers abandon their carts in 2020.

It’s also vital that the payment gateway is secure because obviously we’re dealing with sensitive data here. So, look for elements such as PCI compliance and encryption.

4. User Experience

Of course, you or your staff are going to be the ones actually using these systems. Thus, the software, apps and/or hardware need to be user-friendly.

Furthermore, with tech, there’s likely to be a glitch or an issue at some point. This means that you need a credit card processing company that offers superior customer support. The reason being, the longer your payment processor is down, the more sales you lose.

Now you know what you need to consider when researching credit card processing companies, let’s take a look at how they work.

The Different Types of Credit Card Processing Company

There are two main types of credit card processing company. Here’s the 411:

Credit Card Processor

A credit card processor is the go-between that takes care of transactions. The processor takes the funds from the customer’s account and deposits them in your merchant account. It also ensures that the transaction information is correct, the customer has sufficient funds and notifies the payment gateway that the transaction was successful.

Full-Service Credit Card Processor & Merchant Account

Full-service providers do the same as credit card processors but also provide a merchant account, meaning you don’t need an additional merchant account with a bank. These providers tend to offer lower interchange fees but also charge a monthly fee and additional fees, such as the above-mentioned setup fees and so on.

Depending on the size of your operation and the volume of payments you receive, you’ll have to calculate which type of credit card processing company is going to keep costs low overall. Look for companies that are transparent and straightforward about the way in which they operate and take fees.

#1 – Square — The Best for Ease of Use

Square is a hugely popular, low-fee credit card processing company for online and brick-and-mortar stores.

Its POS app is rich in features and easy-to-use. Square is also known for providing an exceptional, frictionless range of POS systems:

Bonus: you can get the software and Square Reader for free.

The beauty of Square truly lies in its simplicity. The company offers a transparent, straightforward pricing model: 2.6% + 10¢ for every tap (mobile payment), dip (chip card) or swipe (magstripe card) on the POS and 2.9% + 30¢ for e-commerce transactions.

Other benefits include active fraud prevention, end-to-end encryption, a quick sign-up process and live phone support.

Essentially, Square is an easy-to-use all-rounder that would be an excellent choice for a wide range of businesses.

#2 – PayPal Commerce Platform Review — The Best for Individuals & Low-Volume Sellers

You’re no doubt familiar with PayPal (unless you’ve been living under a rock), but you may not be as familiar with its commerce platform.

With the PayPal Commerce Platform you can take payments online, in-store, on-the-go with an iZettle card reader, by QR code, over the phone and via social shopping links:

If you’re a solopreneur or small business just starting out then the platform is a fantastic choice for you. PayPal offers a flat-rate system where you only pay for the processing services you use.

The other great thing about PayPal is that it’s a highly recognizable and trusted brand. Therefore, advertising the fact that you accept PayPal payments could lead to more conversions.

Overall, the PayPal Commerce Platform is a secure, user-friendly and low-cost solution for beginners, individuals and low-volume sellers.

#3 – FIS — The Best for Small Businesses

FIS (formerly Worldpay) is a global banking software provider that offers payment processing solutions for large enterprises, small businesses and e-commerce stores.

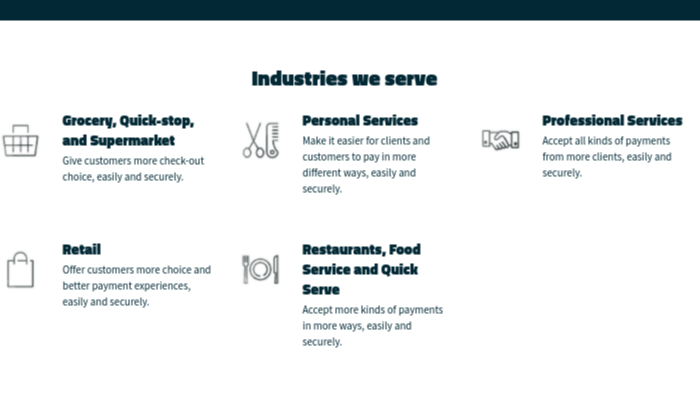

However, this company puts most of its focus on small businesses, serving a range of industries including grocery, retail, restaurants, personal and professional services:

And this is where FIS really shines as they work directly with small businesses to give them competitive terms and rates. You must contact FIS for a quote.

FIS also stands out as a great provider because of their superior 24/7/365 customer support. Furthermore, their software integrates with 1000+ POS systems which is great if you don’t wish to purchase one of their smart terminals.

FIS is the choice for you if you own a small business and want a customizable solution.

#4 – Stripe — The Best for Internet Businesses

Stripe was designed with a range of online businesses in mind, including e-commerce, mobile commerce, subscription services, marketplaces and other platforms. So, if you’re primarily a web-based business then Stripe is the choice for you.

What also makes it the best choice for online businesses is that the company provides tons of pre-built integrations and ready-made checkout forms for major e-commerce platforms, subscription services and the like:

There’s a simple pay-as-you-go pricing model of 2.9% + 30¢ with no additional monthly or setup fees.

Stripe is also one of the most technologically-advanced solutions out there with its dedication to improving the platform and machine learning models for intelligent optimizations.

If you’re looking for a competitively-priced credit card processor that will integrate easily with your online business, choose Stripe.

#5 – Payline Data — The Best for High-Risk Merchants

Payline Data offers in-person, online and mobile payment solutions for companies of varying sizes.

It’s the best option for high-risk merchants that struggle to get approved for accounts elsewhere. Thanks to its partnerships with major banks and premiere support team, Payline Data is able to simplify high-risk account management.

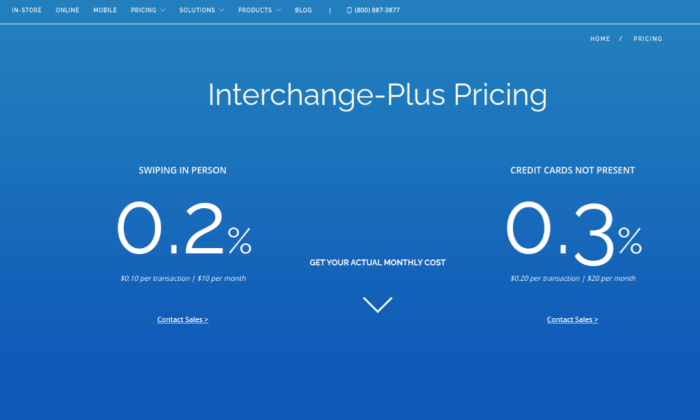

Payline Data’s pricing model is a little more complex than other options with setup, monthly and other additional fees involved. Take a look:

However, you can work out exactly what your monthly costs will be using their payment calculator tool.

Another advantage of using Payline Data is its integrations with major POS, shopping cart and accounting software providers, along with developer APIs for a customizable solution.

As long as you consider the costs carefully, this could be the simplest and cheapest option for those looking for a high-risk merchant account.

#6 – Fiserv — The Best for High-Volume Retailers

This company provides a convenient, secure and reliable payment processing service as well as end-to-end accounting services, if you require them.

What makes Fiserv the best choice for high-volume retailers is the fact that you can negotiate favorable interchange-plus pricing and terms. Or you can opt for flat-rate pricing via its Clover platform.

Having recently merged with international payment processing leader First Data, Fiserv is also a great option for those who operate globally.

Seven out of the ten largest digital merchants trust Fiserv. Plus, retailers can accept a range of payment methods that are popular around the world, such as Alipay.

Fiserv is the right choice for more experienced, high-volume and global retailers.

#7 – BitPay — The Best for Accepting Crypto

Though technically not a credit card processing company, BitPay is a forward-thinking payment processing company for those who want to add crypto into the mix.

Owned by Shark Tank powerhouse, Mark Cuban, BitPay allows you to accept a range of cryptocurrencies online, via email and in-store.

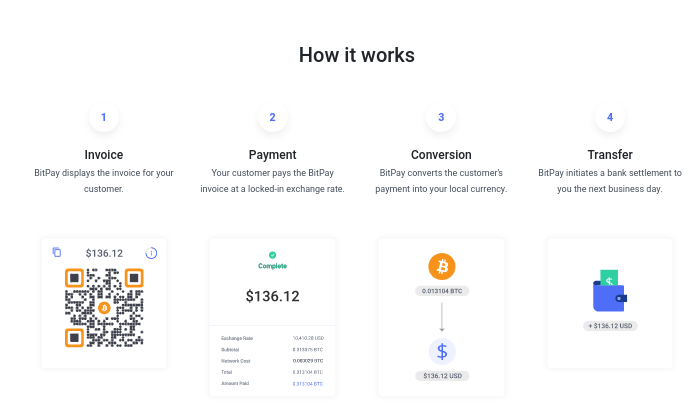

The way it works is simple – the customer gets an invoice, they pay in crypto at a locked-in exchange rate, BitPay converts the payment into your local currency and you receive the payment in your account the next day:

Due to the nature of crypto, you can accept payments from around the globe without having to worry about fraudulent purchases. What’s more, BitPay promises a flat rate fee of 1% and no hidden fees.

So, if you’d like to expand your reach and gain access to the crypto market, BitPay is for you.

#8 – Adyen — The Best for Growing Enterprises

Adyen isn’t for newbies. It counts the likes of Uber, Virgin Hotels, Hunter and Spotify among its customers. So, it’s perfect for growing enterprises that are ready to take their business to the next level.

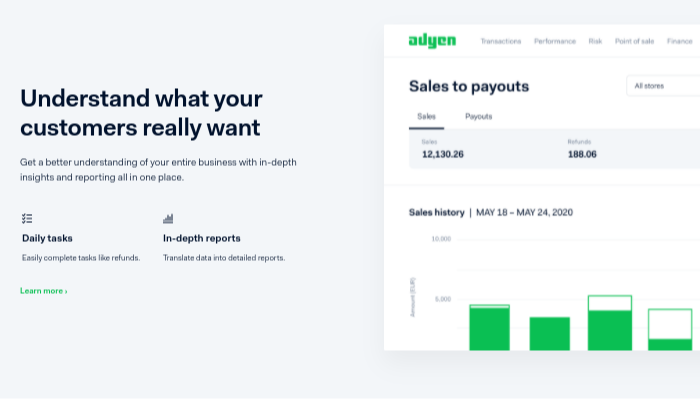

You can benefit from transaction optimization to help you get the most revenue from your sales, as well as in-depth reporting on the platform to better understand your customers and aid growth:

Fees vary depending on the payment method used. Yet, Adyen provides a transparent list of all fees for each payment method on their site.

Other benefits include data-driven security, fraud prevention and access to a dedicated team of payment specialists who will provide you with expert advice.

Overall, if you’re focused on growth, Adyen is the perfect partner.

#9 – Dharma Merchant Services — The Best for Quick Service Payments

Dharma is a low-fee credit card processor that specializes in retail and quick service transactions. In other words, if you own a restaurant, bar, fast food joint or other quick service business then this is a great choice for you.

The company offers a low fee of 0.15% and $0.07 per transaction above interchange for storefronts and restaurants:

Plus, the virtual terminal and app are free. The e-commerce rate is slightly higher at 0.20% + $0.10.

With Dharma, you also benefit from exceptional customer service. If you’re new to credit card processing you can get a free consultation and ask all of the questions you need to. Plus, they offer 24/7 tech support.

Choose Dharma if you own a quick service business and need support along the way.

#10 – Fattmerchant — The Best for Professional Services

Fattmerchant provides a range of smart payment processing solutions, but really nails it when it comes to professional service providers.

The reason being, the platform offers the ability to send invoices and retrieve recurring payments quickly and easily. There’s also the option to create payment links and even buttons to take payments for subscription services.

The platform has features which will speed up your business processes through automation, e.g. automated payment reminders:

Fattmerchant offers a different pricing model to many other credit card processing companies. There’s a flat rate subscription fee starting at $99 but 0% markup on interchange and no pesky additional fees.

Essentially, Fattmerchant’s software is a fantastic choice for a range of businesses, but especially for those in professional services or that take recurring payments.

Summing Up

Naturally, there are several criteria to consider when choosing a credit card processing company. Often it will depend on the type of business you run and the volume of payments you take.

Furthermore, some options are better suited to smaller businesses or beginners while others provide more advanced solutions for experienced, higher-volume companies.

Above all, you want a company that offers transparency, security, strong customer support, great software and hardware and the right pricing model to suit your needs.

Now it’s over to you to explore these top providers further and make the right choice.

The post The Best Credit Card Processing Companies (In-Depth Review) appeared first on Neil Patel.

About us and this blog

We are a digital marketing company with a focus on helping our customers achieve great results across several key areas.

Request a free quote

We offer professional SEO services that help websites increase their organic search score drastically in order to compete for the highest rankings even when it comes to highly competitive keywords.

Subscribe to our newsletter!

More from our blog

See all postsRecent Posts

- Web Hosting September 26, 2023

- Affiliate Management September 26, 2023

- Online Presence Analysis September 26, 2023